Corporate vs Passive Capital Tax Regimes In Real Estate Business (eg Airbnb)

- Are you planning on purchasing a property in Costa Rica to operate a short-term or long-term rentals` business?

- Are you already a property owner in Costa Rica and want to start operating a short-term or long-term rentals` business?

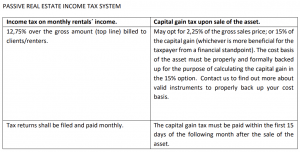

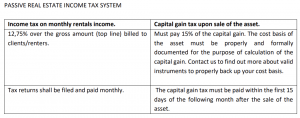

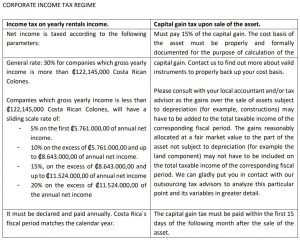

Under the new tax regulation, individuals or companies that carry out real estate rentals´ business (either long term or short term) may be registered on the “Passive” Real Estate Income tax system or on the traditional Corporate Income tax system. Below you will find a summary of the essential elements of each income tax regime, and their implications on income tax payments as well as on an eventual real estate capital gain upon sale. It is very important for each property owner to fully understand which regime works better for her/him, based on the particularities of his property and business, its margin, deductible expenses, intentions to sell or flip within a short/mid-term, etc.

1) FOR PROPERTIES PURCHASED BEFORE JULY 1ST 2019.

2) FOR PROPERTIES PURCHASED AFTER JULY 1ST 2019.

What factors should be taken into consideration when choosing between the passive real estate income tax regime or the corporate income tax regime?

1. Gross income.

2. Deductible expenses and depreciation.

3. Margin before taxes.

4. Short/Mid/long term plans with the property?

Tax advisors and accountants we have reviewed this matter with, consider that in cases where there is an annual gross income greater than ₡106,000,000, if the expenses reach 57% or more of the total income, opting for the corporate income tax regime can be the most beneficial option. In cases where the annual gross income is less than ₡106,000,000, if the expenses reach 50% or more of the total income, opting for the corporate income tax regime can also be more beneficial.

In conclusion, for businesses with a high net profit margin, mathematically it seems to be more convenient to pay 12.75% of gross income than 30% or 20% of net income. Run your own numbers or have your local accountant do so, for you to educate yourself and choose wisely.

On the other hand, each property owner should keep in mind while choosing the tax regime, if her/his intentions are to quickly sell or flip the property with a projected considerable capital gain. On said case she/he should further consider the downsides of the corporate income tax regime, specially the one related with the fact that the capital gain achieved over deductible assets (such as the constructions) and potentially over land as well, may have to be considered as part of the corresponding fiscal year taxable income for income tax payment purposes.

It is important to mention that the request for tax regime change can only be made every 5 calendar years. It is also important to keep in mind that to apply for the Corporate Income Tax Regime, it is mandatory for the owner (individual or company) to have at least one employee reported before the Costa Rican Social Security System CCSS. Last but not least, please take into account that the tax office will automatically include your short or long-term real estate rentals` activities on the Passive Real Estate Income Tax Regime as the “default

regime or system”, unless you expressly request to be included on the Corporate Income Tax Regime. In this case, you will still be forced to report and pay under the Passive Real Estate Income Tax Regime for the rest of the months of the year you start operations on, and if desired, you SHALL request the change of regime during the month of December (the earlier in the month the better) of said year so that the Corporate Income Tax Regime will start applying for the following year.

Feel free to contact us should you have any question or comment. Our goal is for our clients to make well informed business decisions while developing their ventures in Costa Rica. We are here to assist and to connect you if needed with a local tax advisor and/or accountant.

Please bear in mind that this is only a general informative memo for you to have a general understanding of this topic and the importance of getting into the details with an experienced local tax advisor and/or an accountant. This document can´t be used or understood as a tax opinion or as tax or accounting advice rendered by Invicta Legal. Also, please take note that the Corporate Income Tax System percentages and amounts that trigger each percentage will vary from year to year. Tax regulations and their interpretation and applicability evolve and change constantly. Please consult with your experienced local tax advisor and/or accountant, or contact us and we can refer you to any of these professionals.

Alberto Sáenz & the Invicta Legal team.

Founding Partner

Contact me at: [email protected]

Read about our Law Firm at: http://www.Invicta.legal